Will VPN Protect My Credit Card Information On Unsecured Sites?

Nothing trumps the convenience of shopping at home. However, merely going online exposes you to cyber criminals and others who commit identity theft, fraud, and harassment.

That is why dozens of online security approaches, like the HTTPS protocol and Virtual Private Networks (VPNs), come into play.

VPNs provide a plethora of security advantages, like establishing a protected connection that encrypts your internet traffic and disguises your online identity.

But will a VPN protect my credit card on unsecured websites? Read on to learn what a VPN can and cannot do to protect your data.

What is credit card information theft?

Credit card frauds are a type of identity theft that entangles unauthorized access to a user’s credit card information with the purpose of charging purchases or removing funds from the account.

Even so, with the physical credit card no longer being the primary target, how can hackers benefit from unsecured websites and get their hands on your account credentials, to begin with?

How do card details get stolen online?

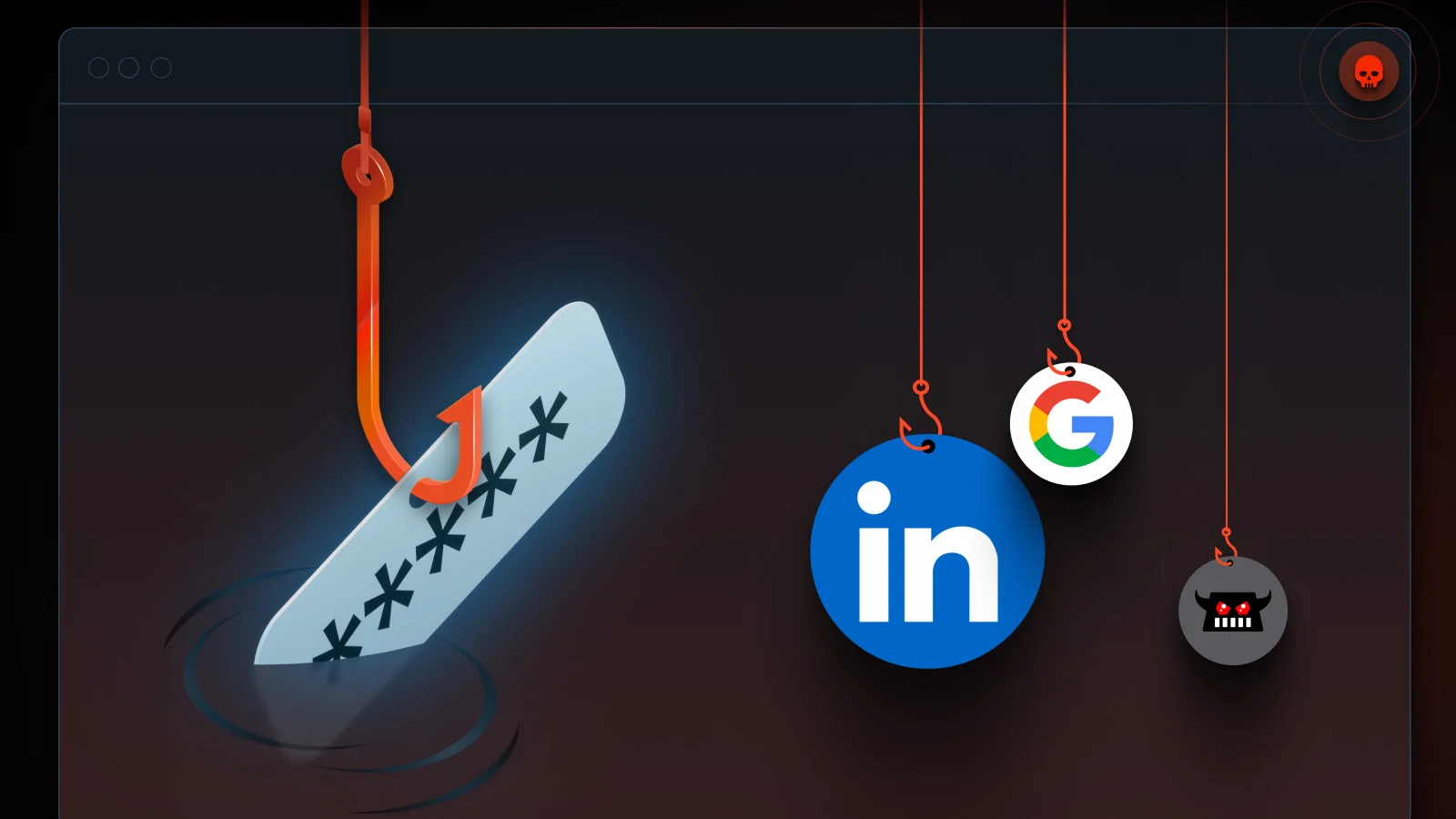

Phishing emails

Phishing emails, for instance, are deployed with a wicked purpose:

- They get you to click on a link that takes you to an unsecured website and requires you to fill in your account information.

- In some cases, they provide an urgent reason to call a fake Social Security company and enlist personal information to “confirm your identity.”

Man-in-the-middle attacks

Additionally, hackers can utilize the Man in the Middle (MITM) cyber attack to secretly manage the communications between two systems and intercept the information to steal it.

Most commonly, they occur on unsecured WiFi networks in public places. Essentially, hackers set up fake hotspots in public places and get ahold of the data of anyone connecting.

Spyware

Downloading and opening a corrupt file from a suspicious email or unsecured website can add such programs to your device and export your credentials. So, be careful what you click on.

Once you have spyware on your device, it can pretty much get ahold of any information on it, including credit card data.

So, as you can tell, there are a lot of ways in which a malicious user can steal your credit card.

However, if you insist on making purchases from less secure websites, launching a reputable VPN provider is a must.

Below we’ll explain how VPNs protect your data and the best practices to avoid falling victim to credit card theft.

Will a VPN protect my credit card information online on an unsecured site?

Yes, a VPN for credit cards protects your credit card information, but not against all forms of data theft.

It will not prevent all attacks, including spyware infection or phishing attempts. Once you voluntarily decide to enter your card info into a scam website, there’s not much a VPN can do.

They do however prevent man-in-the-middle attacks and other forms of data stealing that use traffic tracking.

That’s because VPNs establish a 256-bit AES encrypted network tunnel between your device and the service provider servers.

Therefore, with a VPN connection, you and the intended online portal destination are the only parties who can access your information.

As a result, other frauds and scam artists must break a relatively impenetrable layer of VPN network protection to access your passwords and data.

However, it’s crucial to understand despite the many security advantages VPNs provide, they come with several limitations.

Disadvantages of using VPNs to shop online

A VPN often leads to a potentially slower network connection by adding multiple extra stages to get data from your home network to your internet service provider and back.

This can make for a slightly unpleasant experience while online.

Besides, VPNs may not be allowed to access specific apps and websites, which is called VPN blocking. You may have trouble accessing all sites you want when connected.

Also, users often report a VPN Credit Card Declined error message indicating the website or their bank prohibits payment when connected to VPN.

Nevertheless, if you purchase a premium VPN service offering advanced security features, they guarantee it’s impossible to determine whether you’re using a VPN connection.

So it’s safe to say that with a reputable VPN, you will be able to:

- Bypass highly restricted Websites’ VPN Detection systems and maintain your VPN connection

- With so many VPN locations available, choose one that’s close to you to minimize slowdowns

How to protect your credit card data online

To maintain safety online, it’s important to have a good system and apply it every time you shop online or enter card information for other purposes.

Below are the best practices everyone should do to protect their card data:

- Always make sure your VPN connection is on before entering sensitive data onto websites.

- Use security programs like antivirus software. They offer a complete cover against malware, cyber-attacks, and other online methods of identity theft.

- Always keep your operating system and installed software up to date. They often add new security patches.

- Enable two factor authentication on your credit card account and limit withdrawal/spending amounts.

- Use strong passwords to eliminate the risk of getting hacked on any of your account.

Should you use a VPN on unsecured sites?

Yes, you should use a VPN on unsecured sites. If you’re constantly visiting shady websites, especially ones that lack the HTTPS protocol, you’ll likely lose the data to hackers.

Using a VPN connection, you can encrypt your personal data before it leaves your device and enters the web.

Doing so sends your data to a VPN server, changes your IP address and digital location, and delivers it to your online destination.

In other words, neither the frauds nor your internet service provider (ISP) can see your traffic.

As a result, whoever receives your data can’t figure out where it originally comes from and what the data is.

Keep in mind that you should pick reputable VPNs for the protection to be effective. Pay close attention to free providers because most keep logs and sell data which defeats the whole purpose of VPNs.

The good news is that the VPN market has several well-priced providers that actually deliver what they promise, making every buck worth it.

Summary

Will a VPN protect my credit card on unsecured websites? The answer is YES!

While VPNs aren’t entirely immune to cyber-attacks, they secure your data by adding an extra layer of protection to your network.

Finally, if you’ve become a victim of such attacks, contact your credit card provider immediately to monitor and report any suspicious activities.

FAQs

Yes. VPNs utilize data encryption measures to create a secure connection over unsecured internet infrastructure. However, VPNs can’t stop you from entering personal data into these websites. So always keep an eye open for suspicious-looking sites.

Yes. A VPN provides end-to-end traffic encryption that guarantees your data is not visible when using an unsecured network, like public WiFi.

Unsecured networks are the primary source of data leakage, so you must use a VPN if you want to connect to an unsecured network.

Of course. VPNs are considered an essential defense system against scammers and data snoopers.

When a VPN connection is set up, it acts as a roadblock to would-be data thieves, protecting your online banking from danger.

VPNs don’t impact the functionality of a credit card in any way; it only makes them safer to use, even on less secure websites.

However, some banks, like the Bank of America, prohibit VPN use to prevent fraud.

Quality VPN providers offer a no-logs policy that guarantees no one, not even the VPN provider, can see your data. On the other hand, free VPN services are riskier as they don’t employ such strict policies.

In fact, online shopping and online banking are safer and smarter with a VPN than without it, as it protects your data by encrypting it.

Read our disclosure page to find out how can you help VPNCentral sustain the editorial team Read more

User forum

0 messages