Does VPN Affect Online Banking? [Beginner-Friendly Guide]

8 min. read

Updated on

Read our disclosure page to find out how can you help VPNCentral sustain the editorial team Read more

By using a VPN, you can access the internet securely and protect your online privacy, which is especially important when it comes to sensitive financial information.

Now, you might wonder if a VPN could affect your online banking experience. Will it slow down your transactions or interfere with your bank’s security measures?

In this article, we’ll explore the relationship between VPNs and online banking and weigh the pros and cons of using a VPN for your financial transactions.

Let’s get started.

What are the risks associated with online banking?

There are several potential risks associated with online banking.

Cybercriminals can exploit vulnerabilities in banking systems to steal sensitive data, such as login credentials, credit card numbers, and other account details.

1. Phishing

In this case, attackers trick users into giving away their personal information, such as login credentials or credit card details, by creating fake websites or sending fraudulent emails.

If a user falls for a phishing attack, their personal and financial information can be used for identity theft or fraudulent purchases.

2. Malware attacks

Malware is a type of software that is designed to infect a user’s device and steal sensitive information.

It can spread through email attachments, malicious websites, or software downloads.

If a user’s device is infected with malware such as viruses, ransomware, worms, and spyware. , attackers can access their online banking credentials and other sensitive data.

For example, In 2014, a group of hackers used the Carbanak Trojan horse malware to infiltrate the systems of banks across 30 countries, stealing over $1 billion in total.

3. Man-in-the-middle (MITM) attacks

MITM attackers intercept the communication between a user’s device and the bank’s server to steal their information.

It can be done through public WiFi networks or by creating fake WiFi hotspots.

Consequently, if you connect to one of these networks, you practically give away credentials that will allow attackers to use your bank accounts as if they were the rightful owners.

How can a VPN enhance online banking security?

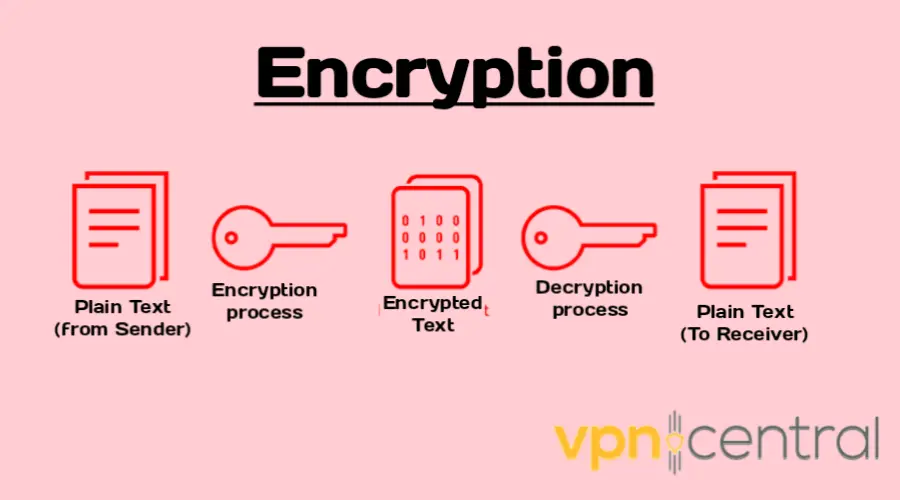

When you use a VPN to connect to your bank’s website, your internet traffic is encrypted and sent through a server in a different location.

Encryption is a technique used to transform information from its original form, called plaintext, into an encrypted form, known as ciphertext.

This means anyone who tries to intercept your internet traffic will only see encrypted data they cannot understand.

As a result, it is difficult for hackers and other malicious actors to intercept and steal sensitive information, such as your login credentials or financial details.

Ultimately, it helps protect you from identity theft and fraud.

Advantages of using a VPN for online banking

Privacy protection on any network

VPNs help protect your privacy by masking your IP address and encrypting your traffic. Thus, they’re preventing your internet service provider (ISP) or cybercriminals from tracking your online activity.

Your data stays secure on any network you connect to, be it your home network, school WiFi, or hotel WiFi.

Access from anywhere

Some banks become suspicious when they notice any activity on your bank account, such as someone logging in or transferring funds from a country different than your residence.

Those banks typically request that you inform them if you plan to leave the country.

Luckily, a VPN will let you access your account from anywhere without suspicions. All you have to do is connect to a server from your home country.

Disadvantages of using a VPN for online banking

Slower connection speeds

When you use a VPN, your internet traffic is rerouted through a server from a remote location which can lead to slowdowns.

Additionally, the data has to pass through an extra layer of encryption and decryption which can add latency.

However, the degree of speed reduction will depend on various factors, such as the distance to the server, server load, and internet connection quality.

Regulatory compliance

Some banks have policies or regulations that prohibit the use of VPNs for online banking.

For example, Bank of America does not permit you to connect with a VPN, it tracks IP addresses for security reasons. Those banks use strong anti-VPN detection systems, so you may not always be able to connect.

Additional costs

Some VPNs require a subscription or extra fees for specific features or services, such as dedicated servers or additional security features.

Remember that even if you are using a VPN, there is still a risk of user error, such as using weak passwords, falling for phishing scams, or accidentally sharing sensitive information.

How to use a VPN for online banking?

1. Use a secure VPN for banking

Choose a VPN provider that has a proven track record of protecting user privacy and security.

Make sure your VPN includes the following features:

- Strict no logs policy

- Strong VPN encryption (AES-256-bit/GCM, ChaCha20)

- Built-in security killswitch to stop all traffic in case the VPN disconnects

- Up-to-date tunneling protocols like OpenVPN, WireGuard or IKeV2

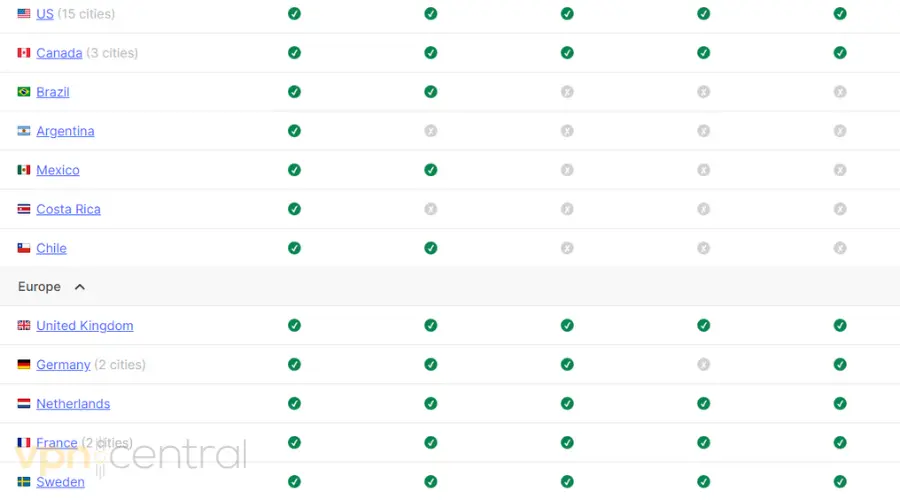

- Good server network in your home country to avoid getting flagged for suspicious activity

Once you’ve decided, there’s nothing easier when it comes to connecting and configuring your VPN for good security:

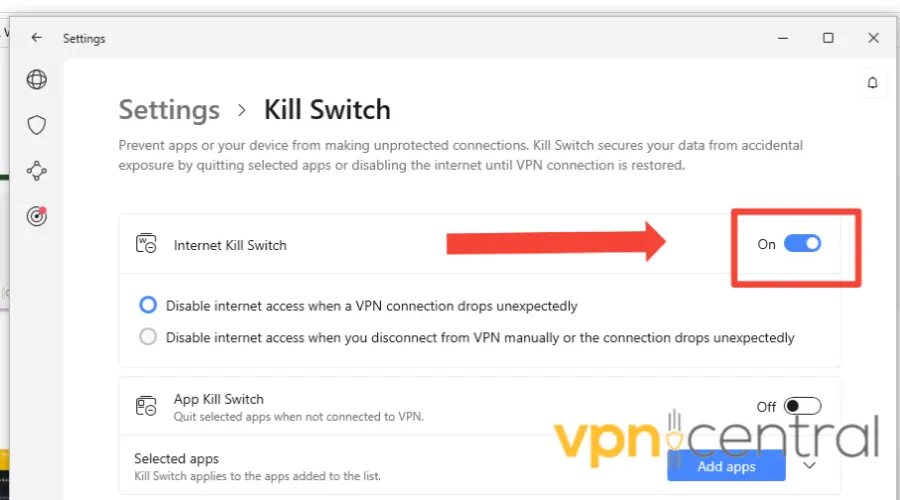

2. Enable automatic kill switch

A kill switch automatically disconnects a user’s device from the internet if the VPN connection is lost.

This prevents sensitive data from being transmitted.

So even if your VPN connection drops for a second, you won’t be sending any information related to your banking or any other online activities until the connection is restored.

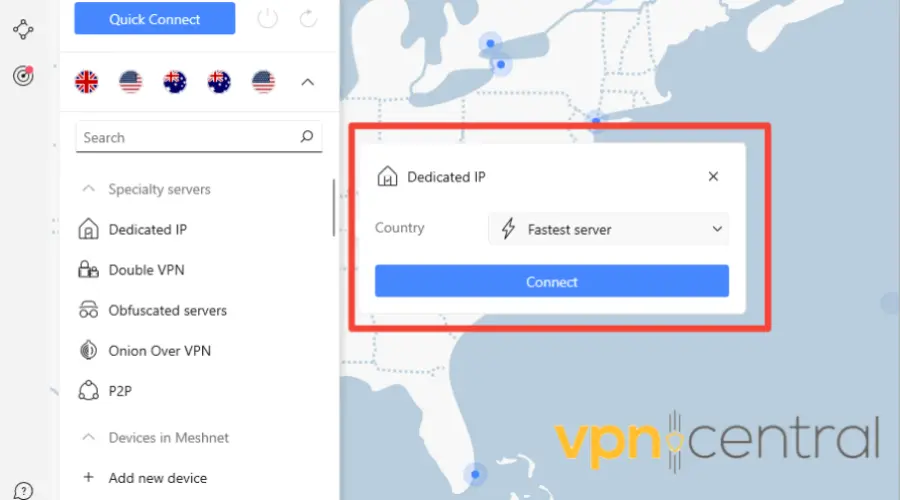

3. Use a dedicated VPN IP address

Some VPN providers offer dedicated IPs for online banking (meaning the server resources are not shared with other users).

They can help with online banking especially if your bank has strict security to prevent fraud. Because the IP is only yours, you can use it all the time before accessing your online banking account.

As opposed to normal VPN IPs which rotate and are picked at random by the VPN app, a static IP will not change, making it less likely for the bank to deem your browsing information as suspicious and block your connection.

4. Choose a server location close to you

Choosing a server location close to your physical location can help improve connection speeds and reduce latency.

And, as mentioned before, it will eliminate the risk of your bank blocking you for suspicious behavior.

5. Use a dedicated device

Consider using a dedicated device, such as a smartphone or laptop, for your online banking transactions. Pick a device that you only use to browse the web on apps and sites you know for a fact are safe and secure.

This way you’ll keep hacking risks at a minimum and ensure you don’t enter your bank information into a compromised device.

Mistakes to avoid when using VPN for online banking

1. Do not use free VPNs

They often lack essential features such as a killswitch and are more susceptible to IP leaks, making them less effective at protecting against hackers.

Moreover, many free VPNs keep and sell user data information.

Additionally, free VPNs often have limited server options, leading to slower server loading times and lower internet speeds.

2. Use strong passwords and enable 2FA

Avoid using commonly used passwords such as “123456”, “password,” or “qwerty.”

Your password should be at least eight characters long. Using more characters and symbols in your password will make it harder for others to guess.

Additionally, enable two-factor authentication when you connect to your VPN. This will ensure nobody else can hack into your VPN account and use it for malicious purposes.

3. Keep personal information private

Be cautious about sharing personal details online or through social media. Cybercriminals can use this information for identity theft and get ahold of your banking account.

For example, they can gather information about your name, job, and location from social media and use these to get past identification processes when trying to login into your online banking portal.

Read more:

Summary

Online banking carries inherent risks, but a VPN can enhance online security by encrypting all data traffic and masking a user’s IP address.

Using a VPN does not negatively affect online banking, but users should be aware of potential disadvantages like slower connection speed.

Ultimately, users should follow general online banking security tips such as using two-factor authentication and keeping personal information private to stay when using a VPN.

FAQs

Yes. Banks can figure out you’re using a VPN. However, they cannot track what you do while you’re connected as they don’t have access to your traffic information.

Some banks have anti-VPN restrictions. They block a set of ports and IP addresses they suspect are associated with VPns or proxies. Switching to a different VPN server usually gets rid of the problem.

Yes. Hackers can connect to VPN when they attempt to get ahold of your account. That does not mean VPNs aren’t secure, just that some VPN users can be malicious.

No. Free VPNs aren’t as secure as their premium counterparts and can contribute to your account getting hacked, but they won’t be the ones hacking into your account. The only scenario when your VPN hacks your bank account is if you’re not actually using a real VPN, but a phishing app disguised as a VPN.

User forum

0 messages